- Apr 22, 2025

-

🧾 Understanding the Importance of an Encumbrance Certificate (EC) in Property Transactions

When buying or selling property—or even applying for a loan against it—one document stands as a gatekeeper to peace of mind and financial security: the Encumbrance Certificate (EC).

Whether you're a first-time homebuyer, a seasoned investor, or someone planning to mortgage property for a loan, the EC plays a critical role in ensuring the property's legal and financial clarity. In this blog, we break down everything you need to know about the EC, why it’s essential, and how to get one.

📜 What is an Encumbrance Certificate (EC)?

An Encumbrance Certificate is an official document issued by the Sub-Registrar's Office that outlines all the registered transactions relating to a particular property. This includes details of:

- Sale deeds

- Mortgages

- Gifts

- Leases

- Any legal liabilities (if applicable)

In simple terms, an EC shows whether the property has any legal dues, loans, or claims against it.

If a property has no encumbrances, it means it’s free from debts or legal issues—and the EC will reflect that.

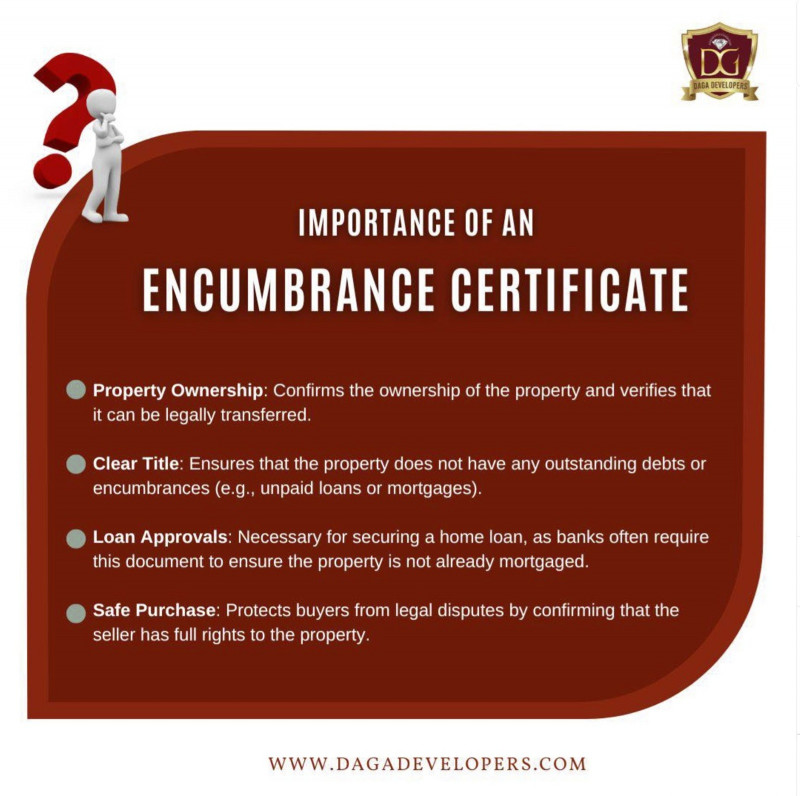

✅ Why is an Encumbrance Certificate So Important?

Let’s explore how this document protects your interests:

1️⃣ Verifies Clear Ownership

Before you finalize any property transaction, it’s important to ensure the seller actually owns the property and has the legal right to sell it.

An EC helps you verify:

- Who previously owned the property

- If the current seller is the legitimate owner

- Whether there were any disputes or loans taken on the property

🛡️ It’s your first line of defense against fraud or forged documents.

2️⃣ Essential for Property Transactions

Whether buying, selling, or transferring ownership, EC is a must-have document.

- Buyers demand EC to confirm clean title history.

- Sellers can use it to prove property legitimacy.

- Government authorities need it for registration and mutation of property.

🏦 Banks also demand EC before processing any home loan or land loan applications.

3️⃣ Prevents Future Disputes

By listing all historical transactions tied to a property, EC acts as proof of clean ownership. It ensures:

- No previous loans are unpaid

- No pending litigation is associated

- No third party has claim on the land or home

This means you won’t wake up years later facing unexpected legal issues. 🙅♂️

4️⃣ Mandatory for Mutation and Property Registration

If you're changing the title after buying a plot or house (mutation), the EC is legally required. The registration office may not allow the transfer of ownership without a valid Encumbrance Certificate.

🏠 No EC = No official property registration.

5️⃣ Required for Loans Against Property

Thinking of using your land or house as collateral for a loan?

Your lender will require an EC to ensure:

- The property is free from previous debt

- No legal complications exist

- The value of the asset is secure

A clean EC = Better chance of fast loan approval ✅

📋 What Does an Encumbrance Certificate Contain?

An EC contains the following details:

If the property has no transactions during a period, a “Nil Encumbrance Certificate” is issued. This means the property is clear.

🧾 How to Apply for an Encumbrance Certificate in Tamil Nadu (and Other States)

Applying for an EC is fairly easy and can be done either offline or online.

🏢 Offline Process (At Sub-Registrar Office)

- Visit the Sub-Registrar Office where the property is registered.

- Fill out Form 22 (EC Application Form).

- Provide:

- Property details (survey number, address)

- Time period for which EC is needed (usually 10–30 years)

- A copy of your sale deed or ownership documents

Pay the required fee.

Collect the certificate after 7–15 working days.

🌐 Online Process (Tamil Nadu Example)

Visit the TNREGINET portal: https://tnreginet.gov.in

Steps:

- Log in or register as a new user

- Go to E-Services > Encumbrance Certificate

- Enter property details and duration

- Pay online

- Download or print your EC once it’s generated

🕐 Processing time may vary by state and portal.

💡 Quick Tips When Requesting EC

- Always request EC for a minimum of 13–30 years to cover full ownership history

- Double-check property survey numbers

- Apply early during property due diligence or loan planning

- Cross-check EC with your lawyer or real estate advisor

🙋 Frequently Asked Questions (FAQs)

Q1: Is EC proof of ownership?

🔸 No, but it helps validate ownership history. The sale deed is your primary proof of ownership.

Q2: How long is EC valid?

🔸 There’s no expiry, but most banks and buyers want a recent EC (within 6 months) during transactions.

Q3: Can I get EC for agricultural land?

🔸 Yes. EC can be issued for all land types, including farmland and residential plots.

Q4: Does EC include unregistered agreements?

🔸 No. Only registered transactions appear in the EC. Private agreements not filed at the registrar won't show up.

Conclusion: Never Buy Property Without an EC

The Encumbrance Certificate is one of the most important documents in any property deal. It may look like just another paper, but it holds the power to protect you from major legal and financial risks.

Whether you're:

- Buying a new plot

- Selling your land

- Applying for a property loan

- Or transferring property to your name

✅ Get your EC. Verify the history. Then move forward.

Daga Developers always assists clients in obtaining and understanding Encumbrance Certificates. Because a wise investment begins with legal clarity and peace of mind.

📞 Need help verifying EC or understanding property documents in Tamil Nadu?

Get in touch with our real estate support team at Daga Developers—your partners in transparent, secure, and well-documented property investment.

Comments :

Currently, there are no comments in this post. Be the first person to comment on this post.